I (Jeff Havenstein) still believe technology stocks are on the verge of a correction... And not only that, but red flags are starting to appear for the overall market.

The tech-heavy Nasdaq is down 4% since I gave my warning in June. And I believe we'll see some more selling over the next few months...

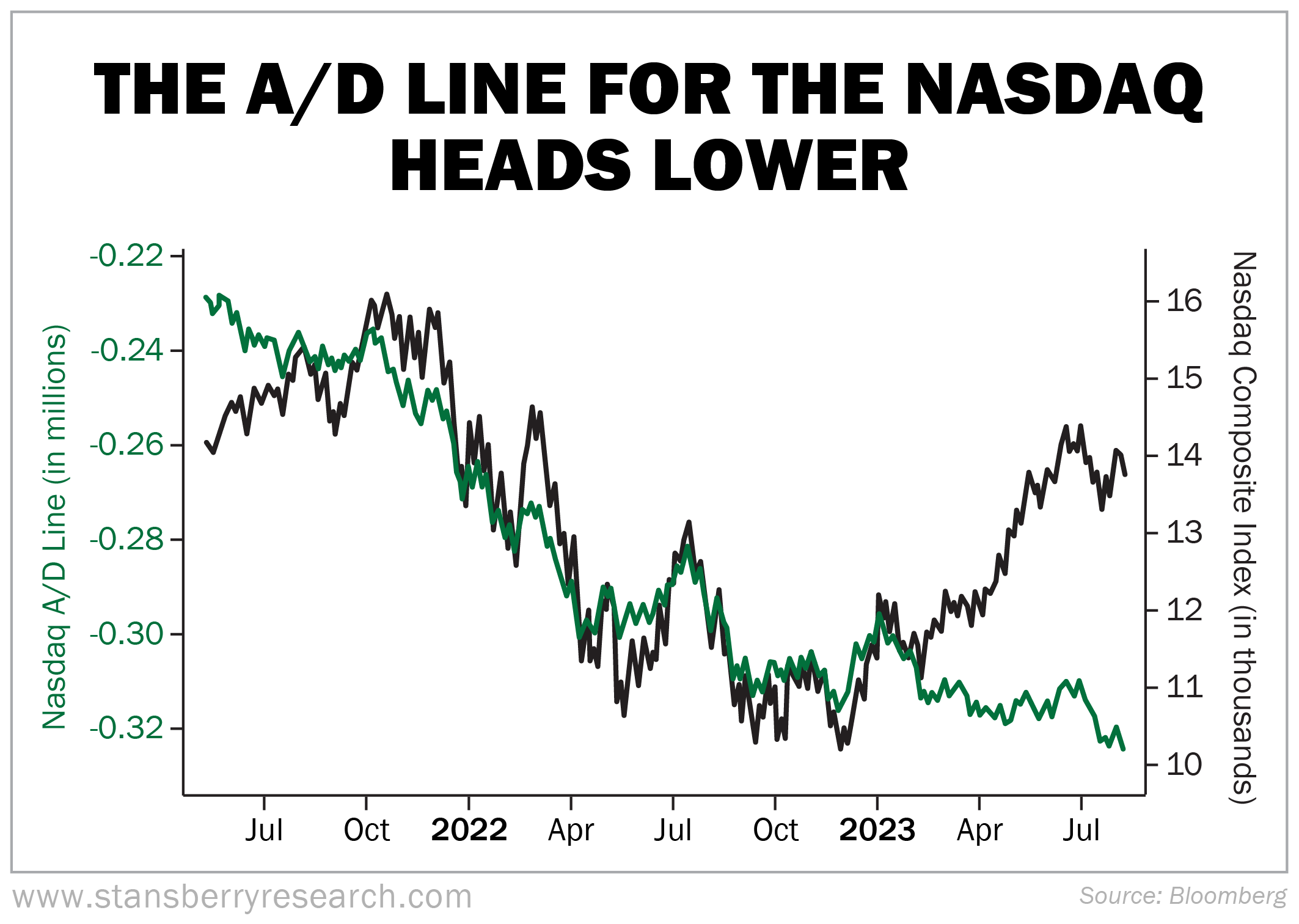

To recap, one of the simplest ways to know a market is healthy is to make sure more stocks are going up versus going down. This is what the advance/decline (A/D) line looks at.

The A/D line takes the number of stocks that went up in a given day and subtracts the number of stocks that went down. If more went up during that day, the line goes up. If more went down, the line goes down.

In a typical bull market, as stocks rise, the A/D line usually goes up, too. When the A/D line moves lower while the market continues to go up, it's time to worry. It means that gains in stocks are concentrated in only a few companies.

Back in June, while the Nasdaq was surging, the A/D line was heading lower.

We're still seeing that divergence today...

Again, this means only a few technology stocks are the ones driving the Nasdaq higher. Most of the technology stocks in the index aren't seeing those gains.

It's a reason to worry.

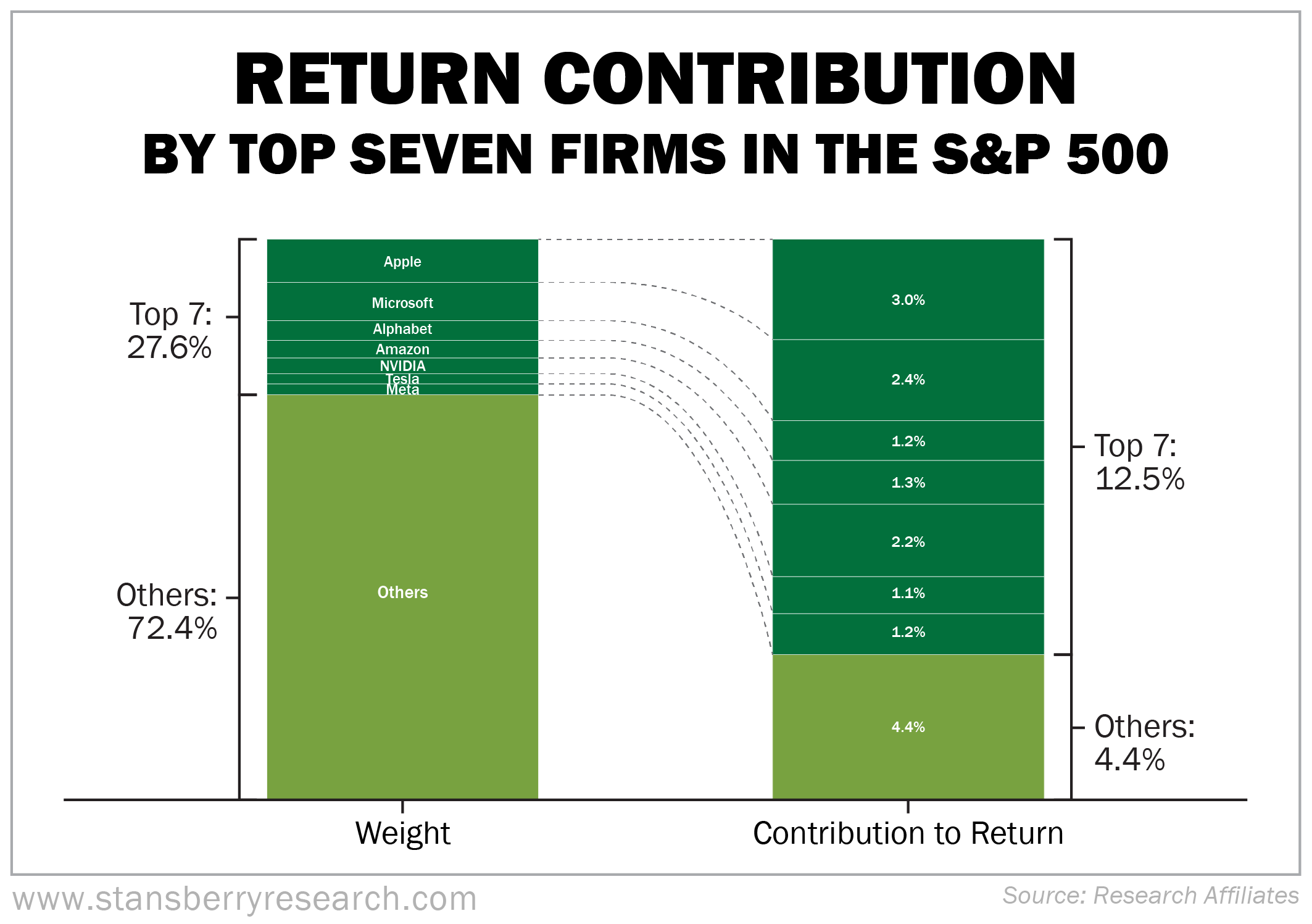

What's also worrisome is the concentration of those few stocks in the S&P 500...

As you know, the S&P 500 is supposed to be a diverse index made up of all different types of stocks. And it is, to a degree... But what we've seen recently is that the biggest companies in the index are making up a larger percentage of it.

Today, the top seven firms – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META) – make up 27.6% of the S&P 500.

These seven stocks are the ones driving the gains, too.

From the start of the year through mid-September, the S&P 500 was up 16.9%... with these seven stocks representing nearly three-quarters of those gains. They contributed 12.5 percentages points to this overall increase, while the rest of the S&P 500 only contributed 4.4 points. Take a look...

There are only a handful of stocks driving the gains in the index. That's worrisome because we know that dynamic can't last forever.

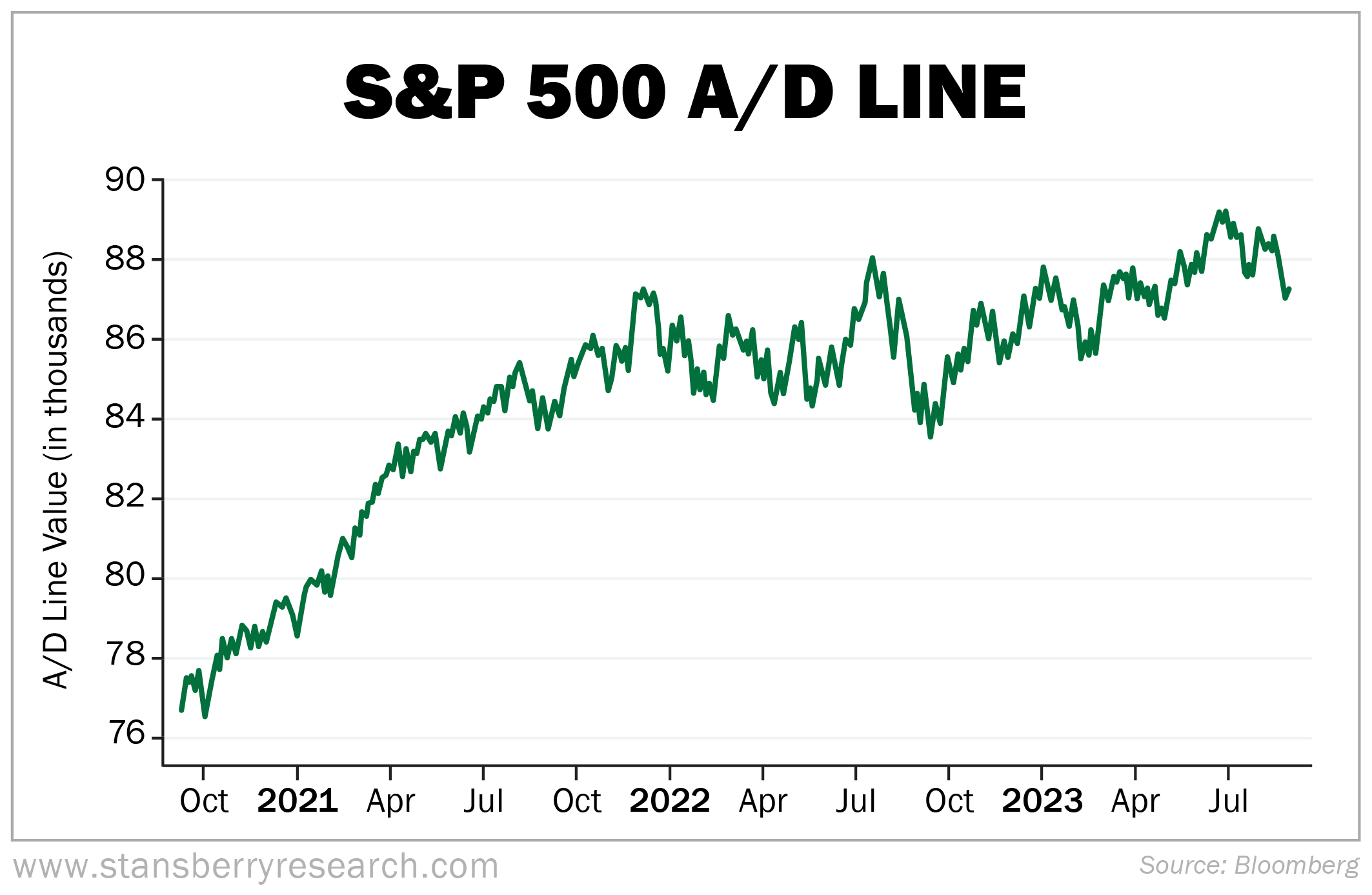

Taking a look at the S&P 500 A/D line, it has been heading lower over the past few weeks. But the index is still only a bit off its highs...

We'll have to see if this trend continues. It's definitely worth keeping an eye on... At the very least, it has me a little more cautious than normal on the outlook for the market.

What We're Reading...

- Something different: Nobel Prize goes to scientists behind mRNA COVID vaccines.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

October 4, 2023