I (Laura Bente) remember the exact day I bought my first investment...

I knew nothing about investing. I couldn't explain what a stock was. I didn't know how to open a brokerage account. I didn't even know anyone who invested in anything beyond savings bonds.

But in college, I met someone who worked for an investment bank. He explained that to secure my future financial independence, I needed to invest.

I didn't have a lot of money. I was working my way through college with bills to pay. I didn't even have $100 to spare, so I wasn't sure investing was worthwhile. But after a couple months of saving and researching, I chose my first ever stock – a diversified mutual fund.

A few months later, the stock market crashed, and I watched that fund collapse more than 50%.

But I wasn't alone...

The financial crisis of 2008 shook the entire market.

Some blue-chip stocks dropped 60% or more. Conservative investors who thought bonds were a safe haven saw them fall 10%.

And the recession pushed a lot of people out of the stock market. According to a recent Gallup poll, prior to the 2008 financial crisis, 62% of Americans owned stocks. As of 2022, that number is down to 58%.

That means a lot of people left money on the table and missed out on the longest bull market in history, which came to an end in June.

Analysts spent years calling for a major crash before it actually happened. And lots of factors are contributing to the current bear market. (We've mentioned most of those recently, including high inflation, rising interest rates, and uncertainty concerning global relations.)

As my colleague Jeff Havenstein mentioned last week, fund managers are extremely bearish right now...

Their portfolios are not positioned to profit if stocks turn higher. While there will likely be more volatility in the weeks ahead, the time to be contrarian is coming.

At Health & Wealth Bulletin, we don't like to predict what happens next in stocks. Most average investors don't have the time to stare at their portfolios all day trying to time what the market will do in the future. And even if they did, it's impossible to predict for sure.

That's why we regularly remind folks that, over time, stocks trend upward.

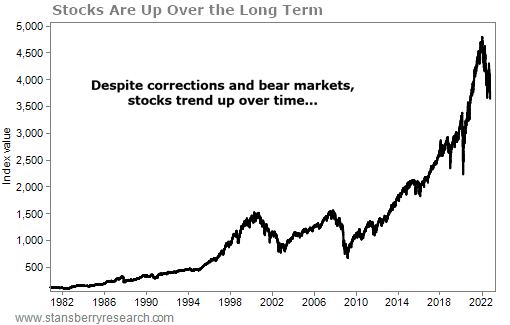

Let's say you're around retirement age today, and you started investing back in 1980. To make it easy, we'll look at the benchmark S&P 500 Index (a basket of 500 leading U.S. stocks)...

You can see the dips where we've been through corrections or bear markets. But despite those dips, the S&P 500 is up 741% over the past 42 years.

Lots of investors try to "time the market," essentially guessing when stocks will go up and when they'll go down. The idea is that you buy at the bottom (when a stock is cheap) and sell at the top to maximize your gains.

It sounds like a great strategy, but it often doesn't work for the average investor.

In 2016, research firm DALBAR tracked what individual investors actually earned on their stock investments. Over a 30-year period, the average investor earned just 3.7% a year... compared with 11.1% for a simple strategy of buying and holding the S&P 500.

Think about that for a moment... Most individual investors miss the movement of stocks and underperform.

That difference comes down to timing. Investors consistently get in and out of the market at the wrong time. They panic and sell at market bottoms. They grow euphoric and buy near the tops. Worse, they move to hot sectors or investments but fail to catch the big moves.

In another study, Fidelity Investments analyzed client accounts to see who had the best performance. The highest-earning group was those who forgot they had investment accounts at Fidelity and never touched them.

The buy-and-hold strategy is a favorite of legendary investor Warren Buffett (aka the "Oracle of Omaha").

In a 2016 interview with CNBC, Buffett said...

The money is made in investments by investing and by owning good companies for long periods of time. If they buy good companies, buy them over time, they're going to do fine 10, 20, 30 years from now.

A buy-and-hold strategy avoids excessive transaction costs and taxes, helps remove some of the distracting emotion of investing, and – if you reinvest your dividends – compounds your wealth... making you even richer, faster.

But this doesn't mean you should ignore your portfolio.

Even blue-chip stocks can go south... think Dell (once the No. 1 maker of personal computers), Sears (formerly America's largest retailer), and General Electric (which was booted from the Dow Jones Industrial Average in 2018).

Take a few hours at least a few times a year and go over the current investments in your portfolio. See how the stocks are performing, check out the latest news and research, and readjust your holdings when you need to... not when the crowd is shouting "BUY" or "SELL."

If you're looking for a good time to put cash into the markets, it's often when most folks are getting out. And right now, plenty of folks are running for the hills as stocks continue trending down.

Last week, two investment gurus I follow – Marc Chaikin and Joel Litman – released a presentation to help people looking for answers, guidance, and relief from the recent punishing market activity.

In it, they revealed a "financial lifeline" that could erase the last eight months of stock market losses for those who act now – and trigger a wave of potential wealth so powerful, it could save your retirement.

If you missed it, catch all the details – while it's still online – right here.

What We're Reading...

- Something different: The British pound just hit a record low.

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP® with Dr. David Eifrig

September 29, 2022