Well, that didn't take long...

We've been warning about this moment for many weeks now. It caught most investors by surprise. But nothing about the recent selling in the market should have surprised you.

Especially in the tech sector.

The tech-heavy Nasdaq is in a full-blown correction. It's down 12% from its mid-July high.

Again, this should come as no shock to you. It's exactly what we've been calling for.

Think back to our June issue titled: Tech Stocks Could Be on the Verge of a Correction. As my senior analyst Jeff Havenstein wrote...

A warning sign just flashed in the technology sector... And that means the rally in the Nasdaq could fizzle out at any moment.

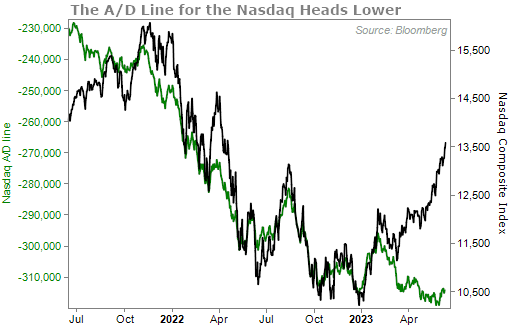

The warning sign was of course the Nasdaq advance/decline (A/D) line. We saw a huge divergence in what the Nasdaq was doing – ripping higher – verses the A/D line, which showed that a number of stocks within the Nasdaq were actually falling.

Here's the chart from mid-June...

Jeff also wrote in July that a 10% stock correction is highly likely. And just one week after that issue, I reiterated the same message saying, "I believe we're on the verge of a big correction, especially in larger tech stocks."

We've been pounding the table to not buy into the meteoric rise in the tech sector for a couple months now.

While the Nasdaq is in a correction, the biggest stocks in the sector are down even more. One is the stock everyone has been talking about all year... Nvidia (NVDA). It's a stock I've had a vendetta against for a few months.

In late June, I voiced my opinion on the AI-chip maker...

It's obvious to see the stock is priced to perfection. Any slipup with its hypergrowth story – even if it's minor – could send the stock barreling down in an instant.

Save that ride for your neighbors and investors who only buy what everyone else is buying. Our advice is to stay far away from Nvidia. We've seen far too many hype stories like this end badly for late investors hoping to make a quick buck.

NVDA is down roughly 23% from its all-time high. The company has seen its market cap shed nearly $1 trillion in just a matter of weeks. To put that in perspective, there are only six stocks in the S&P 500 Index that have a market cap of more than $1 trillion.

We've also seen other risk assets take a plunge on worries of a recession. Bitcoin is down 22% since early June.

In my Retirement Millionaire newsletter, we wrote a special report in early June about three investments to avoid... The first was NVDA. Another was bitcoin.

As we explained, we don't consider crypto a safe haven away from the stock market, despite some folks wanting to claim that. We wrote...

Some people call bitcoin a "digital gold" that will hold its value when everyone panics. That's a pattern we've seen with precious metals. But bitcoin doesn't behave like that.

Rather, bitcoin rises when investors like risky assets like tech stocks. And it falls when they don't.

The chart below shows the tech-focused Nasdaq Composite Index and bitcoin since 2019...

You can't call bitcoin digital gold. It behaves more like a tech stock. So don't fool yourself into thinking you are buying some sort of protection when you are just speculating.

I'm not writing all this to beat my chest. I wanted to revisit all our previous warnings to point out that eventually, logic wins in the market.

NVDA was a bubble. Anyone with eyes could see it... Now we're seeing it pop.

The Nasdaq was running at an unsustainable rate with most of its stocks being down, but it was shooting higher thanks to a few big names. Now we're seeing the index take a bath.

And bitcoin cannot save you in times of volatility. It's a risk asset, and we're now seeing it behave like one.

Investing is hard. That's the honest truth. But it's easy to notice when things aren't right... All you have to do is keep your emotions in check and rely on the data.

Most of all, use common sense.

Before I sign off, it would be irresponsible of me to not remind you that you always need an exit strategy with your investments. The markets plunged on Monday, and every good investor needs to know when it's time to exit a stock during volatility... or whether to keep holding through the turbulence.

If you haven't watched my good friend Porter Stansberry's free presentation yet, I suggest you do so today, as it will go offline tonight. In this video, Porter gives the secret to knowing the exact day to sell your stocks... or when to hold.

What We're Reading...

- Something different: Schwab and Fidelity resolve temporary disruptions on a frenetic trading day.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 7, 2024