I hope you've been paying attention to me the last few weeks...

If you weren't, you've probably lost yourself a lot of money.

You see, a few weeks ago, I started getting nervous. The stock market didn't make much sense to me anymore...

Our economy just had one of the sharpest recessions ever and we are still in the early stages of a recovery. Yet, the S&P 500 Index was at all-time new highs. And the tech-heavy Nasdaq was rocketing past its previous records.

Back in early August, I wrote...

The average company in the S&P 500 currently trades for 26.5 times earnings and 2.5 times sales.

That's expensive.

Over the past four decades, stocks have typically traded around 19 times earnings and 1.6 times sales.

Fresh off new highs, things in the stock market just feel a little too good right now... when it's the opposite in the economy.

Investor confidence is high. And when everyone is thinking one thing, the opposite tends to happen.

I then went on to tell readers that now is not the time to make wild speculations. Instead, it was time to get conservative on stocks.

But it appears the masses don't read Health & Wealth Bulletin. (Although they should.)

Over the past few weeks, speculators have been buying "call options" in droves. Tech stocks kept running higher, and traders wanted to make a lot of money by buying call options on those high-flyers.

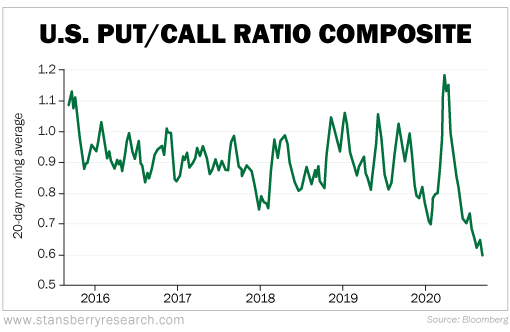

You can see below how traders were buying call options (as opposed to put options) at an extreme...

Well, you probably know how that turned out. Speculators have been crushed recently.

The Nasdaq plummeted 9% over the past week. And again, as I said last month... when everyone is thinking one thing, the opposite tends to happen.

It was only a matter of time before tech stocks took a breather. Nothing goes up in a straight line forever.

My analyst Jeff Havenstein echoed similar comments in his essay last Wednesday, which was the exact day before the Nasdaq tanked...

I truly believe that many investors out there ... see the gains in the stock market, and they want in. Specifically, they see the boom in tech stocks and feel the need to buy.

I don't throw the word "bubble" around lightly. But we're getting close to one.

Citigroup's (C) sentiment indicator is high in the clouds of euphoria...

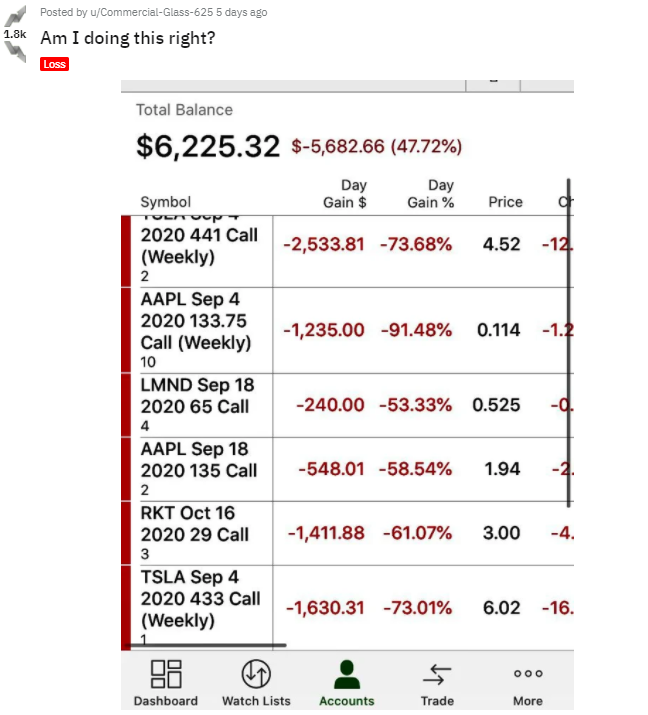

As further proof of the foolishness that has been going on recently, here's a screenshot of one option trader's positions on popular news aggregator and discussion website Reddit...

Here's another trader's post from Twitter...

If you took my advice and became conservative about the stocks you owned, you've likely been able to mostly avoid the carnage in tech over the past few days.

The only question now is: What's next?

There's still a lot that could go wrong in the market, so I don't think now is the big "buy back in" moment. It's possible there's more volatility ahead. Plus, there's still so much uncertainty surrounding November's election.

One thing that you should do is take a hard look at your portfolio. Look and see if you are properly diversified across various sectors and asset classes. If not, it's time to make some changes.

And after you look through your holdings, you'll probably notice that you're not properly diversified outside the U.S.

Unfortunately, most U.S. investors are guilty of this. This phenomenon is called "home-country bias." It's what causes investors to leave too much of their portfolio in the stocks of the country they're from.

It's normal, of course... If you're from the U.S., then you understand the U.S. You see it and live in it every day.

But now more than ever, when U.S. debt is now larger than the size of our economy (for the first time since World War II), you should diversify some of your investments outside of the U.S.

Stansberry Research's Asia-based analyst, Brian Tycangco, thinks you should consider emerging market stocks.

It's easy for American investors to shun emerging market investments because they likely don't spend a lot of time in emerging market countries. So they don't have much first-hand knowledge of what goes on in those economies.

But many emerging markets are different from what the media portrays them to be... In many cases, these are countries with advanced industries, stable laws, and skilled workforces... The major cities of countries like Taiwan, Mexico, China, South Korea, or even Brazil, have modern, robust economies.

Stocks in these countries can lead to lucrative returns.

Plus, emerging market stocks are much cheaper than U.S. stocks. They trade for an average of 15.7 times earnings while U.S. stocks trade up near 26 times earnings.

A simple, one-click way to get exposure to emerging markets is through the iShares MSCI Emerging Markets Fund (EEM). EEM is an exchange-traded fund ("ETF") that holds some of the largest emerging market stocks like China's Alibaba and South Korea's Samsung Electronics.

In my option-selling service, Retirement Trader, we've sold options on EEM many times in the past. EEM is often a slow-moving fund because it's so diversified. But it does provide much-needed diversification away from U.S. stocks.

According to Brian, forces are lining up to create an incredible opportunity in emerging markets. And they're going to propel a bull market that will dwarf the run U.S. stocks had over the last decade.

If you want to make massive gains with emerging market stocks, I suggest you watch a presentation that Brian recently put together. He talks about why the boom in emerging market stocks is happening now, where you need to look for the best gains, and how incredible gains are possible over the next few years.

Click here for all the details.

What We're Reading...

- More details on the iShares MSCI Emerging Markets Fund (EEM).

- Something different: JPMorgan probing alleged misuse of PPP funds by employees, memo shows.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 9, 2020